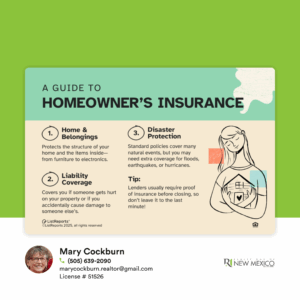

Homeowners insurance is a policy that protects you financially if something unexpected happens to your home- like a fire, storm damage, or even theft. If you’re buying a home for the first time and have only rented before, it’s kind of like renters’ insurance, but it covers the structure of the home too, not just your belongings. It also includes liability coverage in case someone gets hurt on your property. While renters’ insurance is usually optional, homeowners’ insurance is almost always required by your mortgage lender before you can close on a home. Even if it weren’t, it’s a smart way to protect what’s likely your biggest investment.