Realty One of NM

License #51526

![]()

National Real Estate News

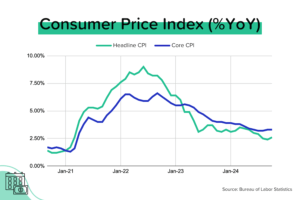

CPI was flat in October

“Core” CPI (which excludes food & fuel prices) rose 0.3% month-over-month in October, keeping annual inflation flat at +3.3%. However, “Headline” CPI (which includes everything) saw annual inflation rise from +2.4% in September to +2.6% in October. Though the lack of progress (getting inflation lower) was disappointing, the market still expects another Fed rate cut in Dec. [Source: BLS]

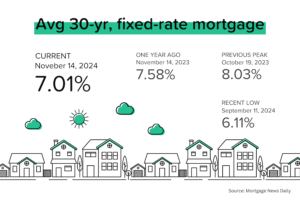

Unlucky number 7

After surging higher for all of October and half of November, average 30-yr mortgage rates appear to be consolidating around 7%. Q: With the Fed cutting short-term rates, why are mortgage rates not following the Fed Funds Rate lower? A: Concerns that President-elect Trump’s policies could boost growth but also reignite inflation and/or further increase the deficit. [Source: Mortgage News Daily]

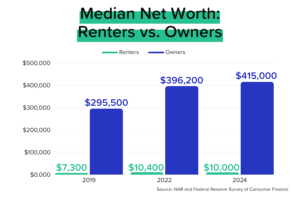

Housing builds wealth

The median net worth (that’s total assets minus total debts) of homeowners has risen from $296,000 in 2019 to $415,000 in 2024. That’s up 40%! Over the same time period, the Case-Shiller national home price index has risen 50%. See the connection? Owning a home builds wealth. Renting a home builds your landlord’s wealth. [Source: NAR, S&P DJI]

Local Market Trends as of November 15, 2024

| Area | Median Price | Active Listings | New Listings – 5 days | Median Days on Market |

|---|---|---|---|---|

| 87015 |

$455,000

0% 0% |

23

-0.3% -0.3% |

1 |

44

-0.3% -0.3% |

| 87112 |

$339,000

0% 0% |

88

0.2% 0.2% |

8 |

47

-0.1% -0.1% |

| 87047 |

$660,000

-0.1% -0.1% |

35

0% 0% |

4 |

79

-0.1% -0.1% |

| 87059 |

$625,000

0.1% 0.1% |

18

-0.3% -0.3% |

1 |

80

0.4% 0.4% |